Sustainable investing is not just a trend, but a smart way to invest. Learn what sustainable investing means, how it’s an important climate solution, and what the future holds for climate-friendly investing.

What Is Sustainable Investing?

Sustainable investing is an investment strategy that focuses on holding stock in companies that are building solutions to climate change, and divesting from (not holding stock in) fossil fuel companies.

This is different from environmental, social, and governance (ESG) funds in that many ESG portfolios and funds still hold fossil fuel companies. For investors who care about climate, ESG often does not align with their financial and ethical standards. This is where sustainable investing comes in.

The Importance of Sustainable Investing

Green investing is not only good for the environment, but it can also be a smart investment.

We believe that fossil fuels are likely to underperform as investments over the coming years, and are no longer a “necessary evil” when it comes to building a diversified portfolio. A few quick stats to illustrate this point:

- From 1989 to 2021, the S&P 500 would have performed better without fossil fuel stocks.

- In 1980, 29% of the market capitalization of the S&P 500 (the 500 largest companies on US stock exchanges) were fossil fuel companies. As of the writing of this piece in February 2022, it represented just 3.52%.

- We would argue that fossil fuels are in a bubble — It’s a debt-heavy, capital-intensive industry. If the price of oil or natural gas drops too far or too much of their margin is needed to pay an escalating carbon tax (or a carbon tariff, like the EU's Carbon Border Adjustment Mechanism), thousands of sites will no longer be financially viable.

Dig deeper into the numbers behind divestment and climate-friendly investing in Chapter 3 where we explore the performance of sustainable investing.

Climate Change Can't Be Solved Without Investment

Secondly, sustainable investing is necessary to solve climate change. Scientists, researchers, and engineers have set goals around decarbonization and laid out viable pathways to achieve these goals (some of our favorites: Project Drawdown, IEA, McKinsey). While these experts have minor differences, they all basically agree on the following: to solve climate change, we need to build a lot of stuff. We have to completely transition our global energy system to run without fossil fuels, from electricity to cars, ships, and industry.

From solar panels to battery gigafactories to long-distance, high voltage power lines, this approach will require the creation of additional infrastructure for renewable energy. And such building takes investment. And that’s just the energy system; we need to do more in agriculture and the global supply chain.

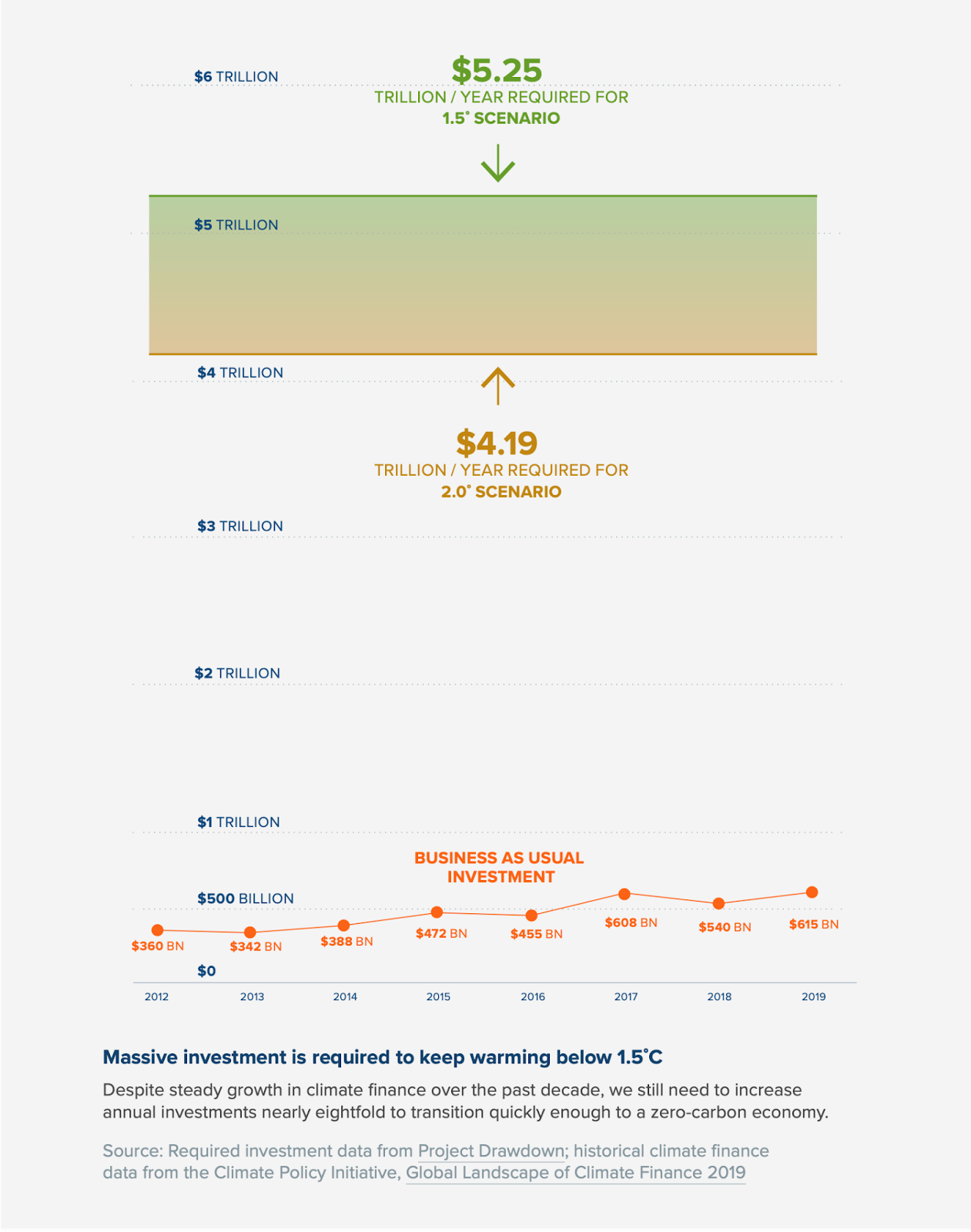

According to Project Drawdown and the Climate Policy Initiative, in 2019, the globe invested ~$600 billion into climate solutions. For humanity to achieve its target of "turning off the tap" by 2050, we need to invest closer to $5.2 trillion per year into climate solutions.

That’s a lot of money. But here’s the good news:

#1 Filling that investment gap isn’t charity. Much of it is already profitable, and the rest is on a path to being profitable soon.

#2 We can solve climate change and we have most of the resources to do it.

Sustainable investing is not only the most realistic path to solving climate change, but it is also smart investing.

Why Impact Investing is Important

To avoid catastrophic 1.5ºC warming, humanity needs to invest ~9x more into climate solutions each year. We need to research, develop, test, iterate, build, deploy, and massively scale up new technologies. And we need to deploy the existing clean technologies as fast as we can.

As touched on above, none of this, from early-stage R&D to building the next battery gigafactory, will happen without investment to fund it. The good news is that much of what needs to be built to "turn off the faucet" of carbon emissions is straightforward and likely to provide a strong return on investment.

The Growth of Sustainable Investing

Investment funds that focus on environmental, social, and corporate governance (ESG) are becoming increasingly popular, with major investment banks creating entire departments dedicated to ESG research and portfolio management.

Financial robo advisors such as Carbon Collective are continually developing strategies and portfolios to support both the financial objectives of individual investors and their sustainability goals that go beyond the often obscure criteria surrounding “ESG” investments.

In the years ahead, we hope to expect greater transparency, accountability, and climate-friendly options in where our money is invested, helping to ensure both a healthy economy and planet.

Moving Beyond “ESG” Investing

ESG (environmental, social and corporate governance) investing is a risk framework that takes into account the environmental, social, and governance risks of a company. It seeks to generate long-term returns by investing in companies that have sound policies in place with regard to their impact on people and the planet, and minimizing environmental, social, and governance risks.

This sounds great in theory, but ESG funds and portfolios often contradict climate-focused investors’ goals. For example, the top ESG funds and portfolios still invest in fossil fuel companies — some even include ExxonMobil, for example.

Most of these funds also invest a very small percentage into companies that are focused on building climate solutions. Thirdly, the fees and expense ratios associated with many of these funds and portfolios tend to be high. The cherry on top is that companies like BlackRock pay ratings agencies a lot of money to give their ESG funds a rating — and the criteria they use to determine what qualifies as “ESG” or not isn’t public information.

We believe that ESG waters down all ethical categories to the point where these portfolios are simply “less bad,” but not actively pushing for real change.

Our sustainable investing theory of change has three parts:

- Divest from all industries that rely on fossil fuels

- Reinvest in the companies building climate solutions

- Pressure the rest — Use our leverage as individual investors to vote & pressure companies to decarbonize

In summary, sustainable investing is pulling investments away from the fossil fuel industry, reinvesting that money into climate solution companies, and using our shares to vote on aggressive shareholder climate resolutions. It is our thesis that investing in the companies building climate solutions is not only an important way we will mitigate the worst effects of climate change, but is also a smart investment.

The Future of Sustainable Investing

The future of sustainable investing is bright as more people look to align their investments with their values and do good for the planet while also earning a return.

It is important to note that the technologies we need to solve climate change already exist — and are already experiencing growth. The IEA’s 2050 Net Zero Report illustrates the type of growth required from the market-ready technologies from now until 2050. Solar, wind, and electric cars are the climate solutions most prepared for rapid growth.

Sustainable Investing FAQs

What is sustainable investing?

Sustainable investing is an investment strategy that focuses on holding stock in companies that are building solutions to climate change, and divesting from (not holding stock in) fossil fuel companies. This is different from environmental, social, and governance (ESG) funds in that many ESG portfolios and funds still hold fossil fuel companies. For investors who care about climate, ESG often does not align with their financial and ethical standards. This is where sustainable investing comes in.

Why is sustainable investing important?

To avoid catastrophic 1.5ºC warming, humanity needs to invest ~9x more into climate solutions each year. We need to research, develop, test, iterate, build, deploy, and massively scale up new technologies. And we need to deploy the existing clean technologies as fast as we can.

None of this, from early-stage R&D to building the next battery gigafactory, will happen without investment to fund it. The good news is that much of what needs to be built to "turn off the faucet" of carbon emissions is straightforward and likely to provide a strong return on investment.

What is human-driven climate change?

Put simply, the challenge of human-driven climate change can be defined by three key points:

- There is too much carbon dioxide and other greenhouse gases in our atmosphere.

- The insulating effect of these molecules means less of the earth’s heat reflects into space.

- The more heat that gets trapped, the more it changes our global systems. From directly melting ice caps to disrupting historic ocean and wind currents, boosting the intensity of storms, and the length and duration of droughts.

How can humanity solve climate change?

We can simplify the huge challenge of solving climate change into three steps:

- Stop adding excess carbon dioxide and other greenhouse gases to the atmosphere. This requires transitioning from fossil fuels to sustainable energy.

- Protect the remaining natural systems and start regrowing as many as we can to increase our planet’s natural carbon-carrying capacity.

- Mop up the excess, ancient carbon dioxide until atmospheric carbon dioxide levels have returned to pre-industrial levels.

What data supports the transition from coal to renewable energy?

- It costs less to build new solar arrays than continue operating existing coal plants in most areas of the globe.

- Campaigns to shut down coal plants and brand coal as negative for the climate and health have succeeded (like this one from the Sierra Club).

- Even coal-reliant countries like India have explored halting any new production of coal facilities due to their inferior economic situations.

- Coal’s significant air pollution can lead to civil unrest, particularly in economies with growing middle classes, like China and India.

- Investors have shown a lack of confidence in the long-term potential of coal. The Dow Jones US Coal Index hit all-time lows in the summer of 2020 before Dow Jones discontinued it.